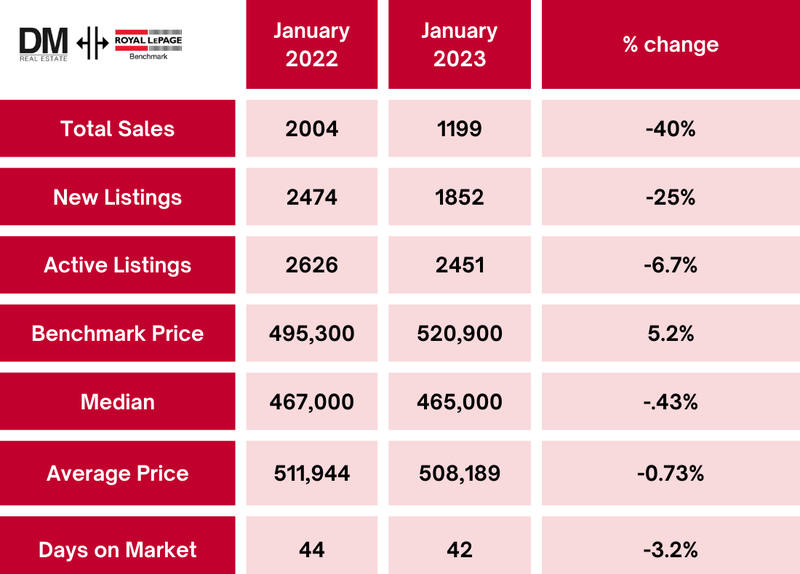

The market needs more listings! More specifically, it needs more detached homes ranging from 400K to 700K. The number of buyers will only increase with the Spring market around the corner and interest rates leveling off for the time being. The number of new listings in January fell to the lowest levels seen since the late 90s. Low inventory is affecting most segments of the market but it is particularly a problem for mid-range detached single-family homes making it challenging for people looking to buy their first home. Low inventory usually means fewer sales and sales activity did slow compared to the high levels reported last year but remained consistent with long-term trends. As you can see in this graph, there's been less activity, fewer new listings, and lower inventory numbers since last January but prices are more or less staying the same.

The market needs more listings! More specifically, it needs more detached homes ranging from 400K to 700K. The number of buyers will only increase with the Spring market around the corner and interest rates leveling off for the time being. The number of new listings in January fell to the lowest levels seen since the late 90s. Low inventory is affecting most segments of the market but it is particularly a problem for mid-range detached single-family homes making it challenging for people looking to buy their first home. Low inventory usually means fewer sales and sales activity did slow compared to the high levels reported last year but remained consistent with long-term trends. As you can see in this graph, there's been less activity, fewer new listings, and lower inventory numbers since last January but prices are more or less staying the same. One thing to note is that we are seeing a shift in buying habits with only 47 percent of all sales being for detached homes because higher lending rates are making people rethink their plans and pushing them to the multi-family, townhouse, or condo lifestyle. These lending rates are also making it difficult for homeowners to upgrade from their starter homes which in turn means there is less inventory for those entering the market. If you have a townhome and you’re thinking about selling, now would be a good time to seriously consider it. The mid-range detached homes will likely continue to see increased activity over the coming months but this could strongly depend on inventory numbers which will be a main driver.

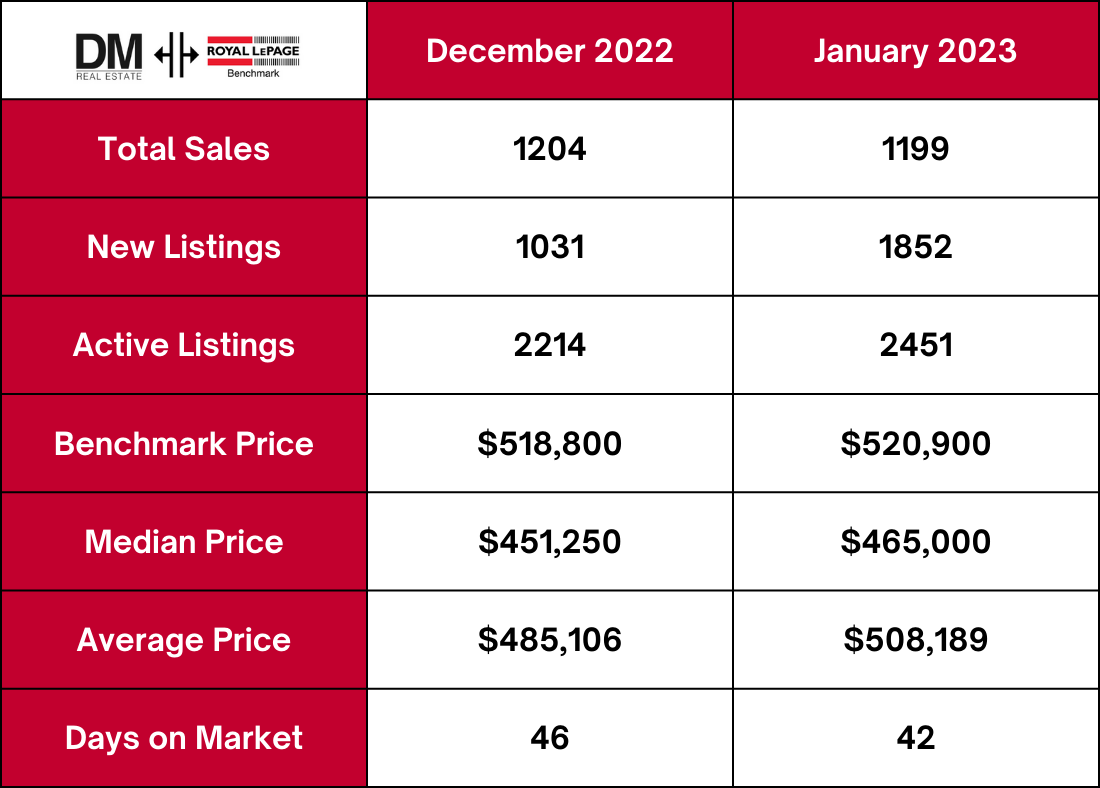

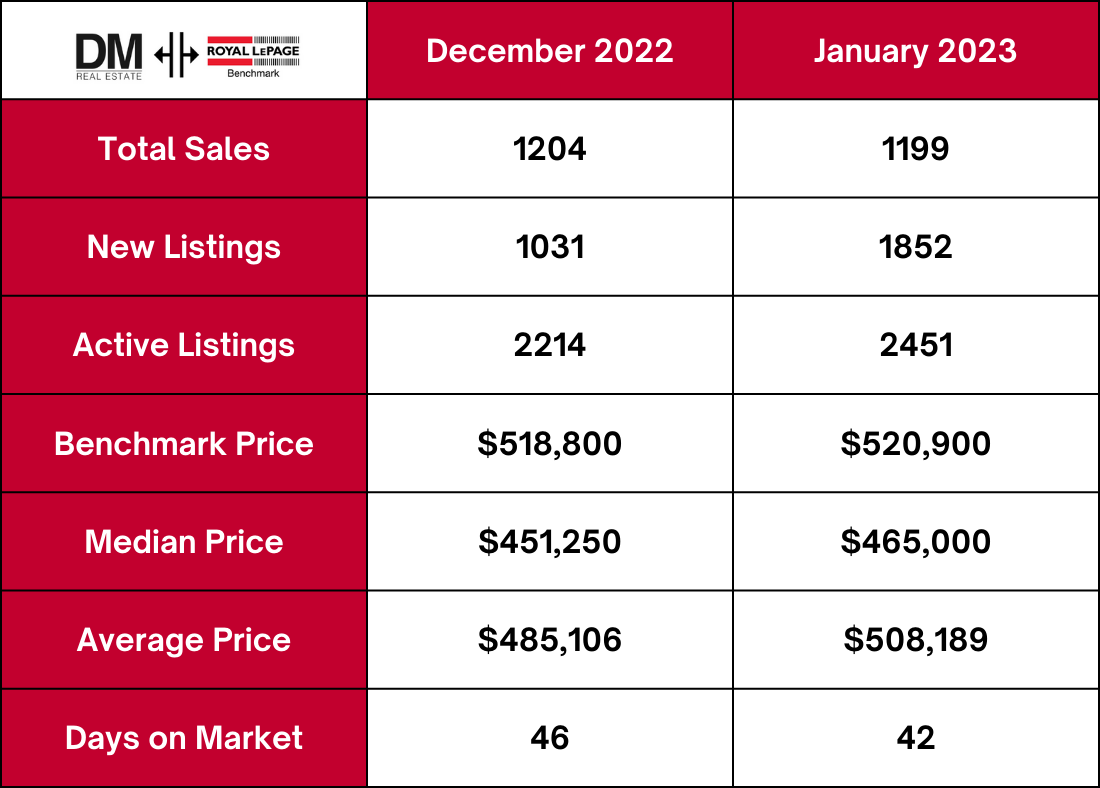

With 2,451 units available in inventory, levels remain 43 percent lower than long-term trends for the month. Overall inventory levels are slightly lower than last January and there is significant variation by price range. While conditions are not as tight as last year, lower supply levels are preventing a significant shift toward balanced conditions and prices did trend up slightly over last month breaking the seven consecutive month slide. As of January, the benchmark price reached $520,900, 5 percent higher than last January, but still well below the May 2022 high of $546,000.

With 2,451 units available in inventory, levels remain 43 percent lower than long-term trends for the month. Overall inventory levels are slightly lower than last January and there is significant variation by price range. While conditions are not as tight as last year, lower supply levels are preventing a significant shift toward balanced conditions and prices did trend up slightly over last month breaking the seven consecutive month slide. As of January, the benchmark price reached $520,900, 5 percent higher than last January, but still well below the May 2022 high of $546,000.

There was a significant increase in new listings compared to December but that's not saying a lot because things tend to slow down in December with the holidays and lead up to them, Typically we see an increase in inventory for the Spring market as the spring and summer timelines are usually more appealing to both buyers and sellers. More listings is needed to balance things out a bit so if you're thinking of listing soon, you might see a great window of opportunity to do it right now, reach out and let David and his team at DM Real Estate assess the value of your home and help you come up with a plan.

Keeping you connected to Calgary's real estate market,

---Claire